AUD/JPY Price Analysis: Climbs above 97.00 on risk appetite improvement, buyers eye 98.00

- AUD/JPY climbs to 97.27, fueled by positive risk appetite, despite Australia's weak jobs report.

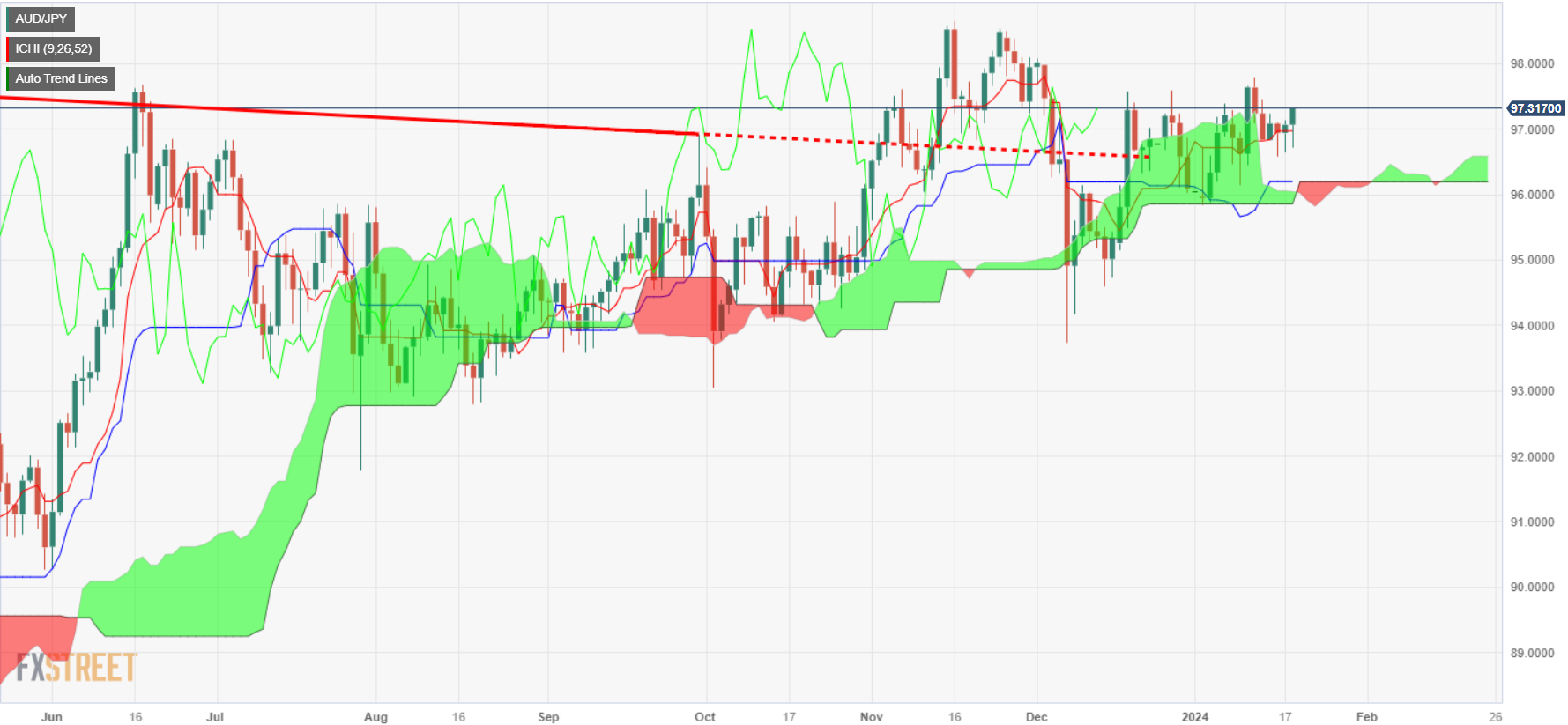

- Bullish technical outlook as pair surpasses Ichimoku Cloud, aiming for 97.79 resistance.

- Downside risks for AUD/JPY below 97.00, with supports at 96.64, 96.58, and critical 96.00 level.

The Aussie Dollar (AUD) extended its gains against the Japanese Yen (JPY) for the second straight day as risk appetite improved, although soft jobs data from Australia might deter the Reserve Bank of Australia (RBA) from tightening monetary policy. At the time of writing, the AUD/JPY trades at 97.27, up 0.25%, on the day.

Therefore, from a technical standpoint, the AUD/JPY is upward biased once it has broken above the Ichimoku Cloud (Kumo), which has cleared the path to challenge the next cycle high seen at 97.79, the January 11 high. Once cleared, buyers could test the 98.00 figure, ahead of the November 24 high at 98.54.

On the other hand, if bears drag prices below the 97.00 figure, that could open the door for further losses. The first support would be the January 17 low of 96.64, followed by the January 16 low of 96.58. The next support would be the 96.00 figure.

AUD/JPY Price Action – Daily Chart

AUD/JPY Key Technical Levels