GBP/USD flat for the week, unable to recover above 1.3000

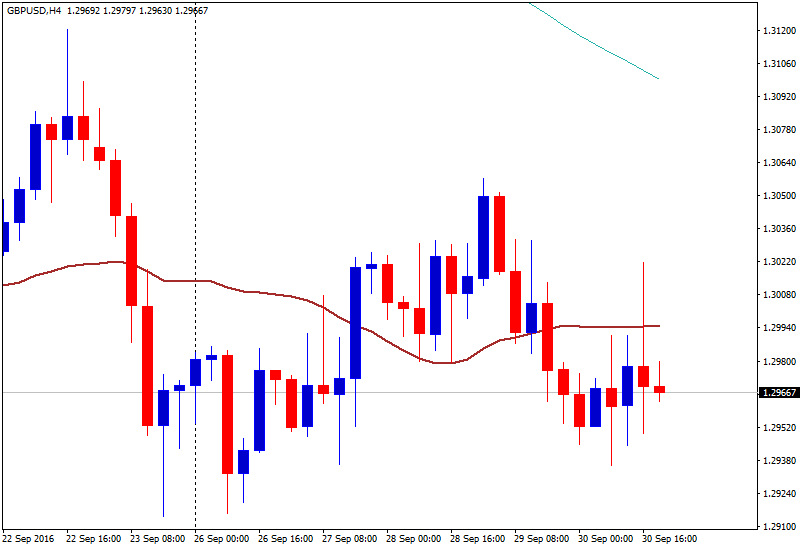

GBP/USD is about to end the week around the same level it had seven days ago. During the week it moved in a small range. It reached 1.3057 on Wednesdays but failed to hold above 1.3000. To the downside, it found support around 1.2910/15, where also last week lows area located.

Near the end of the week it was trading at 1.2960/70, flat also for the day. The pair is consolidating 100 pips above 2016 lows. So far it has been holding above post-Brexit lows but is still facing pressure on fears about the process of the separation of the United Kingdom from the European Union.

Next week

“In the UK, focus remains on the economic impact of the UK’s EU vote and UK politics. We have several important data releases next week. In terms of hard data releases, we get production data for August on Friday”, said analysts from Danske Bank.

Regarding the US, the key event next week will be the NFP report on Friday. The report is likely to weigh on Federal Reserve expectations.

After moving in a 100-pips range during most of the week, volatility in the GBP/USD pair next week is likely to rise. To the upside, traders will look to see if it can confirm levels on top of the 1.30 handle while to the downside, September lows at 1.2910/15 and 2016 lows at 1.2860/65 are on the radar.