WTI recedes from fresh 2019 tops beyond the $56.00 mark

- Prices of WTI exceed the $56.00 mark and clinch YTD peaks.

- WTI advances for the second session in a row.

- Oil rig count rose by 3 during last week to 857 active oil rigs.

Prices of the barrel of the American reference for the sweet light crude oil are hovering the $56.00 mark today, a tad lower than earlier 2019 tops near $56.30.

WTI up on USD-selling, trade hopes

The rally in crude oil remains well and sound on Monday, moving further north of the $56.00 mark per barrel, or fresh yearly highs.

In fact, prices of the WTI are extending the upside momentum since monthly lows in the vicinity of the $51.00 mark seen on February 11, always on the back of rising expectations of a positive outcome from the US-China trade talks, which are expected to resume this week in Washington.

Furthermore, the ongoing turmoil around Venezuelan output (or rather absence of it) plus comments from Saudi officials stressing the country could curb its output further is also sustaining the up move in prices.

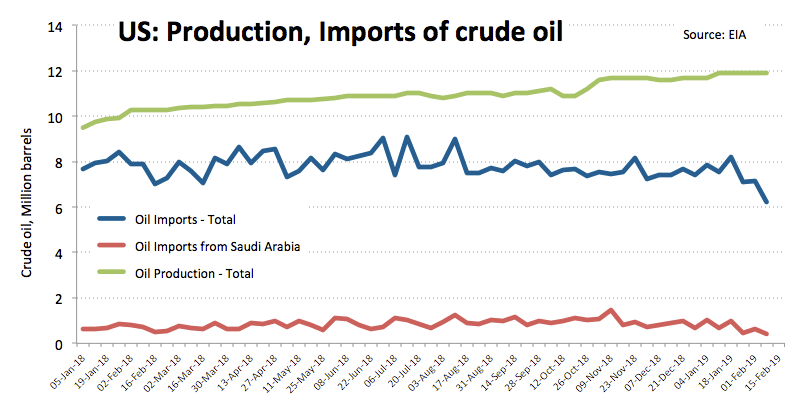

Additional news around crude oil noted the OPEC cut its forecasts for the demand of its crude oil following prospects of slowing economy, while the EIA now sees US oil production ticking higher to 13.2 mbpd in 2020 (from 12.9 mbpd in the previous report).

What to look for around WTI

Hopes of a US-China trade deal have lent extra oxygen to crude oil prices in past sessions and this should remain a key driver in the very near term ahead of this week’s negotiations. On the broader picture, the ongoing OPEC+ agreement to curb oil production, US sanctions against Venezuelan and Iranian oil exports and the so-called ‘Saudi Put’ should keep a firm floor under crude prices.

WTI significant levels

At the moment the barrel of WTI is up 0.70% at $56.13 facing the next hurdle at $56.24 (2019 high Feb.18) ahead of $57.05 (100-day SMA) and then $58.00 (high Nov.16 2018). On the downside, a breakdown of $53.82 (10-day SMA) would aim for $51.15 (low Feb.11) and finally $51.11 (55-day SMA).