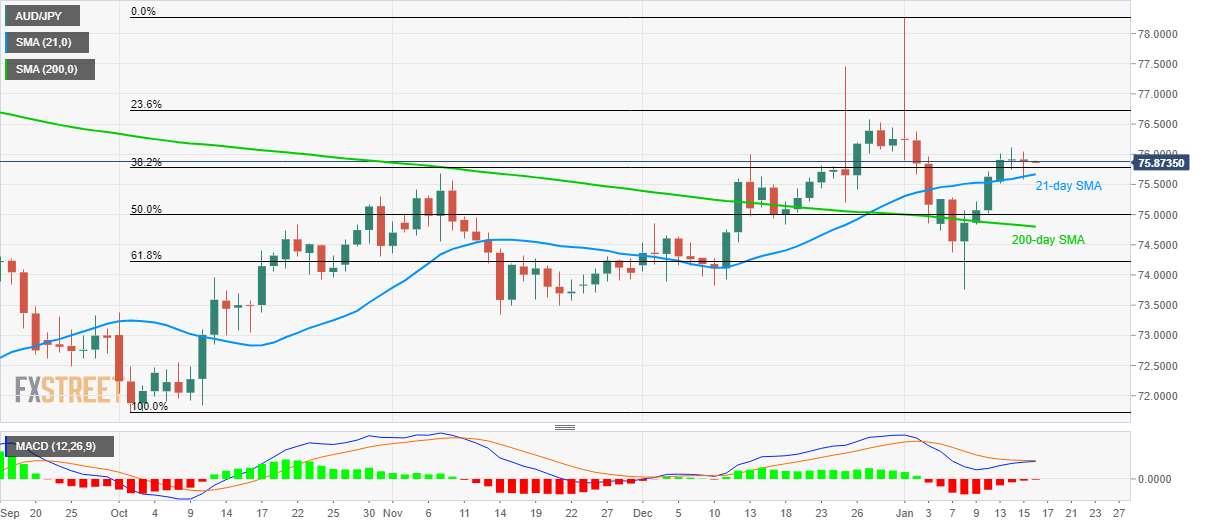

AUD/JPY Price Analysis: Buyers await break of 76.10, sellers seek entry below 21-day SMA

- AUD/JPY trades modestly changed inside a 40/45-pip range between the monthly high and 21-day SMA.

- MACD is likely to turn in favor of buyers.

- 50% Fibonacci retracement, 200-day SMA will challenge sellers.

AUD/JPY repeats the failure to take-out monthly high while trading near 75.90 amid the initial Asian trading session on Thursday. Even so, the pair stays above 21-day SMA for the fourth consecutive day.

Additionally, a 12-bar MACD histogram is also near to crossing the red zone and signal support to the buyers.

That said, the monthly top surrounding 76.10 becomes the immediate upside barrier holding the key to the pair’s fresh run-up. In doing so, December 27 high near 76.60 will be the target for the Bulls.

On the downside, pair’s declines below 21-day SMA level of 75.65 could trigger fresh selling pressure towards 50% Fibonacci retracement of the pair’s rise from October 01 to the year’s start, at 75.00.

It should, however, be noted that a 200-day SMA level of 74.80 will become additional support, other than 50% Fibonacci retracement, that can question sellers past-75.00.

If the quote stays below 74.80, odds of its drop to 61.8% Fibonacci retracement near 74.20 can’t be ruled out.

AUD/JPY daily chart

Trend: Bullish