Back

10 Feb 2020

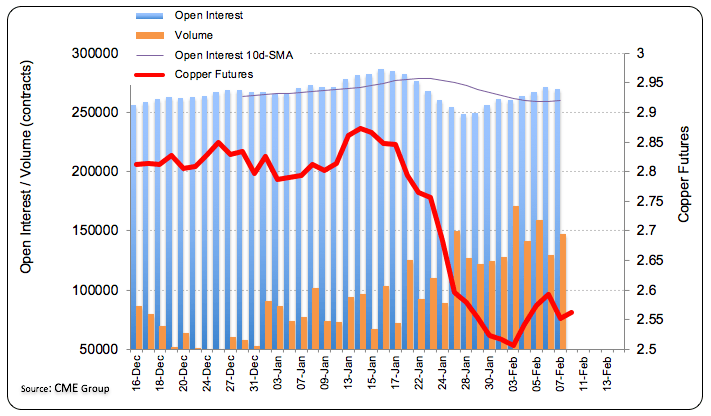

Copper Futures: Diminishing odds for a deeper pullback

Investors scaled back their open interest positions in Copper futures markets by almost 1.5K contracts on Friday, reversing three consecutive builds, as per advanced data from CME Group. Volume, on the other hand, extended the erratic performance and rose by nearly 17.5K contracts.

Copper faces the next hurdle at 2.6250

Prices of the future of the base metal dropped on Friday amidst declining open interest, hinting at the likeliness that further losses appear somewhat unlikely in the near-term at least. Against this, the potential recovery in prices should meet initial resistance at monthly tops around 2.6250 (February 6th).