WTI firmer, targets $54.00 ahead of the EIA

- Prices of the barrel of WTI extend gains to the $54.00 area.

- Concerns over the Chinese COVID-19 ease and support oil.

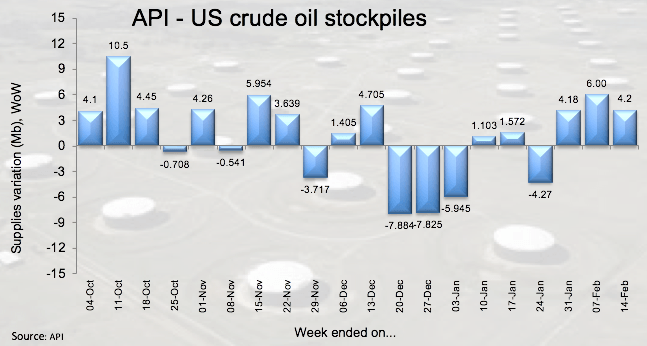

- The API reported (on Wednesday) a 4.2M barrel build during last week.

Crude oil prices are extending the weekly recovery and are trading closer to the key barrier at the $54.00 mark per barrel of WTI.

WTI firmer on coronavirus, looks to EIA

Prices of the West Texas Intermediate are testing the vicinity of the $54.00 mark per barrel on Thursday following ebbing concerns around the Chinese COVID-19, while prospects of extra stimulus by China are seen tempering the impact on the demand for crude oil.

Also supporting the recovery in the commodity, the conflict in Libya is extending more than expected and without any apparent solution after the Libyan National Army (LNA) keeps the blockade on the country’s key ports, oilfields and pipelines, forcing the production to drop by around 1.2 mbpd for the time being.

In the data space, the EIA will publish its weekly report on US crude oil inventories later in the NA session. Late on Tuesday, the API reported a 4.2M barrel build during last week, adding to the previous week’s 6M build and keeping oversupply concerns well on the table.

WTI significant levels

At the moment the barrel of WTI is gaining 0.63% at $53.80 and faces the next barrier at $53.99 (monthly high Feb.20) seconded by $54.35 (weekly high Jan.29) and then $56.40 (200-day SMA). On the flip side, a breach of $50.90 (weekly low Feb.18) would aim for $49.31 (2020 low Feb.5) and finally $42.20 (2018 low Dec.24).