WTI sticks to daily gains above $28.00 ahead of API

- The barrel of WTI trades with decent gains near the $29.00 mark.

- Saudi Arabia to ramp up exports by around 10M bpd in April-May.

- The API’ weekly report on US crude oil inventories is due next.

Prices of the WTI are trading within an unusual narrow range on Tuesday, with gains capped just above the $30.00 mark per barrel and support emerging a couple of dollars below in the $28.30 region.

WTI stays under pressure on supply, demand concerns

The barrel of the West Texas Intermediate is navigating just above weekly lows in the $28.00 neighbourhood (Monday) amidst unremitting concerns over the impact of the COVID-19 on the oil industry and supply effects from the Russia-Saudi Arabia price war.

On the latter, the Kingdom announced it plans to increase its oil exports by around 10M bpd in April-May, adding extra pressure to the already fragile scenario between the two oil-producers.

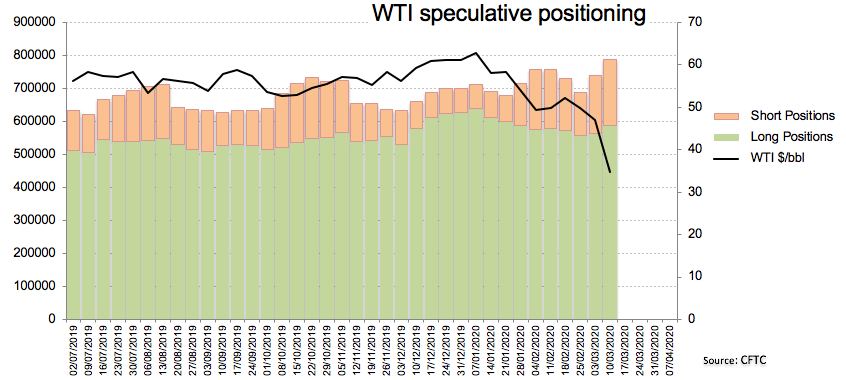

On another front, speculators dragged net longs in the commodity to the lowest level since late October 2019 during the week ended on March 10th, as per the latest CFTC Positioning Report.

Later in the NA session, the API will publish its weekly report on US crude oil supplies ahead of the DoE’s report on Wednesday and the weekly oil rig count by Baker Hughes on Friday.

What to look for around WTI

Crude oil prices remain under pressure amidst challenges from the demand side via the large impact of the COVID-19 on the global economy, and particularly on the Chinese economy, which is the second largest oil importer in the world. Negative drivers on the supply side come from the ongoing Russia-Saudi Arabia price war, which is expected to remain unabated in the near-term and aggravated by the tangible possibility that Saudi Arabia could increase its oil production by nearly 12M bpd in the near-term.

WTI significant levels

At the moment the barrel of WTI is gaining 0.29% at $28.64 and faces the next up barrier at $36.28 (high Mar.11) seconded by $40.00 (round level) and then $42.89 (21-day SMA). On the downside, a breach of $27.29 (2020 low Mar.9) would expose $26.61 (monthly low Sep.2003) and finally $25.80 (monthly low Apr.2003).