Silver flounders up to test secondary daily resistance

- FOMC weighs on the greenback and elevates precious metals.

- Silver rises to test critical daily resistance on US dollar weakness.

The price of silver was over 1.2% higher following the Fed on Wednesday and it has risen further in Asia to test daily resistance in the highs near $25.22.

Bulls took advantage of a weaker US dollar environment and moved in on a daily resistance target in the highs of the day.

The Federal Open Market Committee left the Federal Funds Rate at 0.00-0.25% in what was seen as a hawkish hold as per the statement and a note that said the "economy has made progress toward goals since setting the bar for taper in December and will continue to assess progress in coming meetings."

Meanwhile, the pace of asset purchases was left at USD120bn/month, made up of Treasuries and agency mortgage-backed securities.

The dollar initially rallied on what was regarded as a hawkish hold but then dropped back to the start again before falling on dovish rhetoric by the chairman, Jerome Powell.

DXY 15-min chart

Powell put the emphasis of concerns on the Unemployment Rate and economic data rather than speculation of run-away inflation risks.

This has capped the upside in the greenback for the meanwhile allowing silver to move higher to test a key daily resistance area.

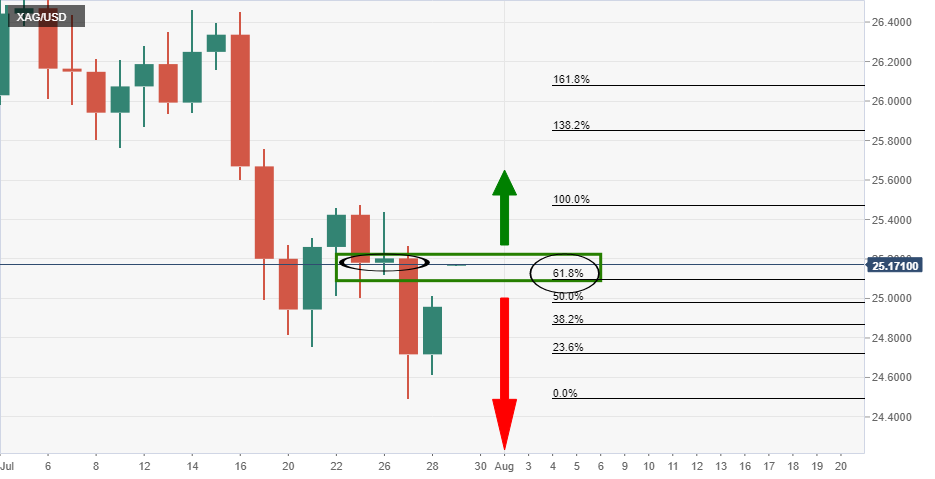

Silver price analysis

The price has rallied a full 61.8% and the bulls now eye a break of the daily resistance for an upside extension into fresh bullish territory.